PDF editing your way

Complete or edit your w9 form 2022 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export w9 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your w9 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your w9 form 2021 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form W9 2017

What Is W9?

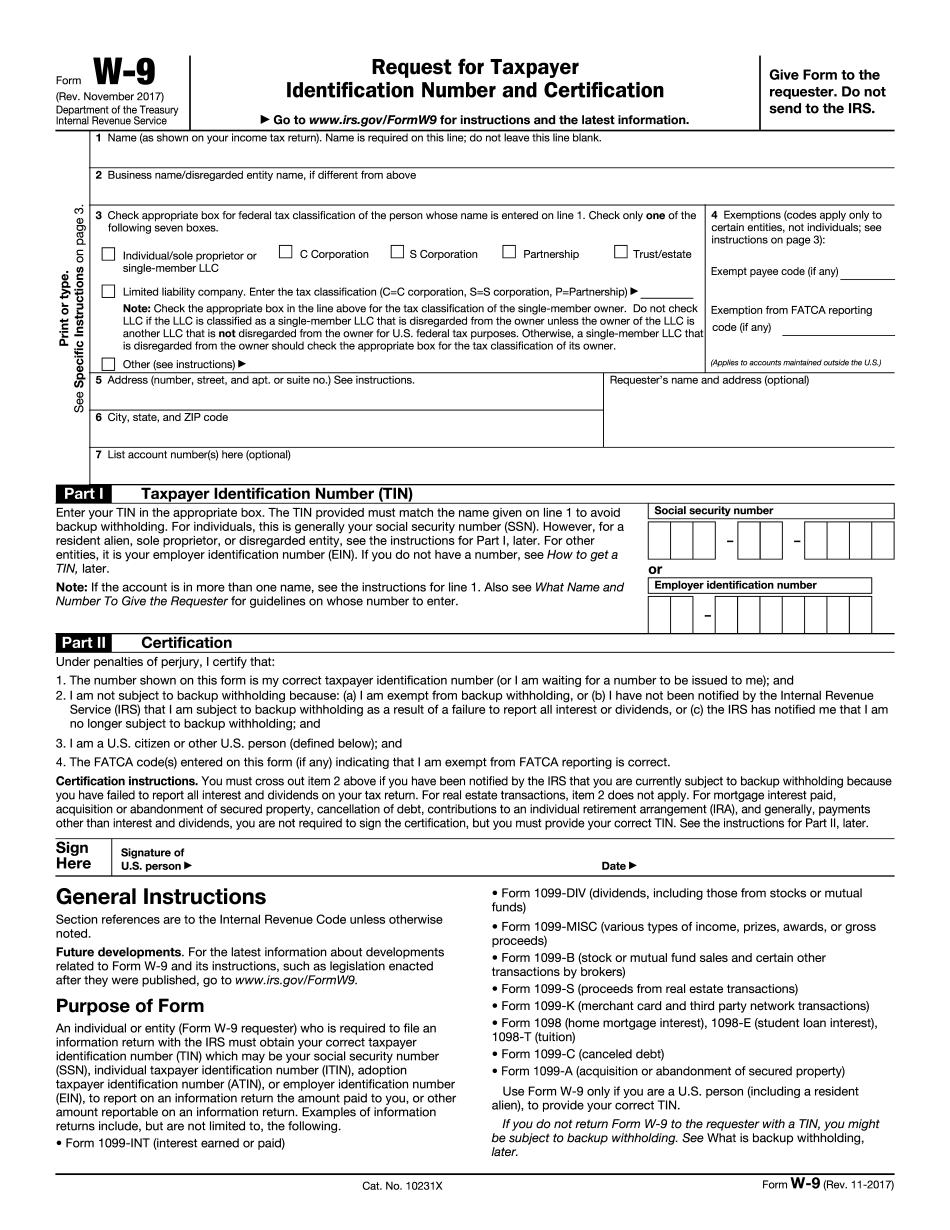

Meet a renewed IRS form W9 2025 in PDF format. Here you can fill, sign, download and print a taxpayer identification number request just in a few seconds.

A W-9 Form is a document used to confirm a person’s TIN. It concerns both a U.S. citizen and a resident alien. This paper is usually requested by businesses hiring independent contractors. It is also needed to help the payee avoid backup withholdings.

The employer has to prhired individuals with the form, collect the necessary data and retain it to forward then to the IRS at the end of fiscal year.

Forget about the paperwork routine preparing the document online. Due to changes in requirements and document’s format, use a renewed IRS form W9 2017.

The superior should ask the employee to fill out W-9 right after the hiring process. They have to praccurate information in the empty fields of the form.

Read the following instruction:

- Pryour name.

- Indicate your business name.

- Check the appropriate box for federal tax classification.

- Insert exempt payee codes.

- Write your address, city, state and ZIP code.

- List account numbers and specify the requester’s name and address (optional).

- Enter your TIN.

- Sign the file electronically and put the current date.

Before signing, review the document on errors. Download the file to your device and send to the employer. If required, print out the paper and bring it personally.

Online methods aid you to arrange your doc management and increase the productivity of your workflow. Observe the short guideline as a way to complete Form W9 2017, steer clear of problems and furnish it in a very timely manner:

How to finish a W 9 Form?

- On the website while using the kind, simply click Start Now and pass towards the editor.

- Use the clues to fill out the pertinent fields.

- Include your own information and contact details.

- Make confident you enter proper facts and quantities in appropriate fields.

- Carefully check out the subject material from the variety also as grammar and spelling.

- Refer to help you portion for those who have any questions or handle our Guidance staff.

- Put an electronic signature on your Form W9 2025 aided by the guide of Sign Instrument.

- Once the shape is completed, push Carried out.

- Distribute the all set sort by means of email or fax, print it out or help you save with your system.

PDF editor allows for you to definitely make variations for your Form W9 2025 from any online connected machine, customize it based on your needs, indication it electronically and distribute in various ways.