Award-winning PDF software

form w-9 (rev. november )

July 17, 1998. (1) Form W-2 for all Federal and State employees, including contractors. (2) Form W9 for all non-Federal workers, such as farmers, farm laborers, truckers, janitors, home care providers, childcare providers, home health care providers and others. (3) Form TIN for Federal contractors; for all others see section B. (4) Forms W-2G and W-2H issued by the Social Security Administration. (5) Forms W-2S and W-4 issued by the Department of Defense; see section E for information on Federal military pay. (6) Form 1099, W-2 and Schedule EK, if there are deductions allowed. (7) Form 1042, Income Tax Return for Federal Individuals, Federal Corporations, and Estate and Gift Tax Return, if applicable — see section W. (8) Form 5498, if the tax result is subject to tax in other countries. (9) Form W-2, if the employee is self-employed and the work is incidental and not primary employment. (10).

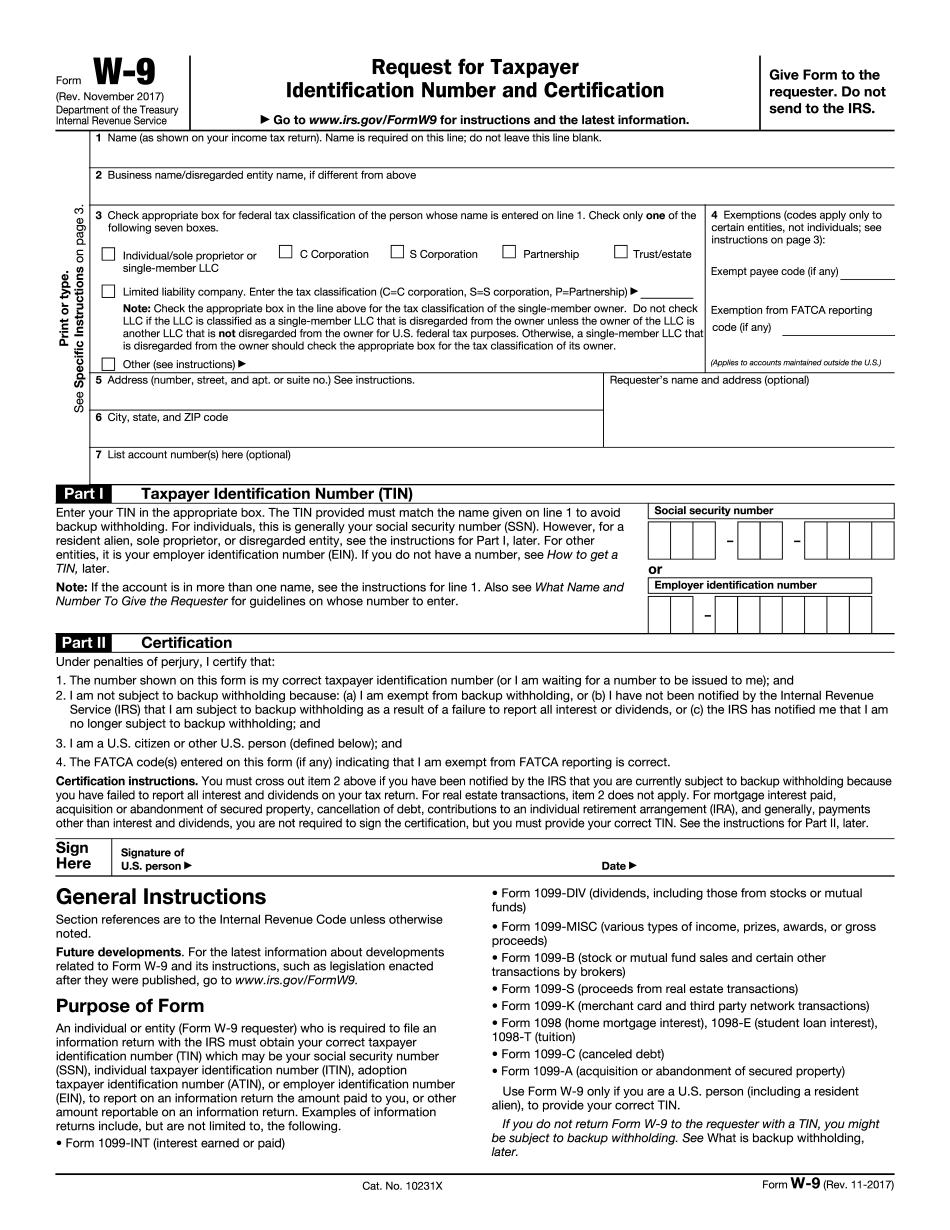

W-9 - internal revenue service

The IRS has not determined yet whether to use the amended procedures for Form W-9 or not.” 24. The IRS has not determined whether to use the amended procedures for Form W-9 or not. If an amended request for an individual taxpayer identification number (ITIN) is submitted, the IRS will review and approve that request, and it will be sent to the client's employer, if applicable; otherwise, the employer will provide the ITIN to the IRS. 25. The Form W-9 is used to obtain tax information from the employer, financial institution or other entity reporting to the IRS. It also provides the employer, financial institution or entity reporting to the IRS a copy of the return and taxpayer instructions. 26. If the employer pays a balance due under a tax return, the information reported on the Form W-9 may not contain all the information needed to compute the amount of the owed.

Form w-9, request for taxpayer identification number and - internal

All references to Forms 1099, W-2, or 1099-DIV and/or C-24 and/or other similar items on this document are for illustrative purposes only and not for any statutory or regulatory purpose. The Forms are provided for informational/identification purposes only. (3) The document can be reviewed, and you may request a copy, by calling, or by using the link in the e-mail notification on the form. (4) This is a Request for Release of Information and not a Claim for Exemption, Declaration of Intent to Request a Certification and Statement on Exemptions, or a Declaration for Certification and Statement on Exemptions. (5) If the document is being released for your records, please make use of the “Please Complete” instructions within the “Please Review Your Request to Have Information Relating to You Released” box before completing the release form. (6) The form does not release the following: any of the applicant's passport, government-issued ID, student.

--w9-form.pdf

Enter the type of financial arrangement‒ partnership, limited liability company or S Corporation (check if applicable). Enter the name and address of the entity. If the entity's address is not available, enter the entity's telephone number (if available) or e-mail address. Enter the number of shares of common stock (number of shares of common stock, 50,000,000 or 1,000,000) or units of preferred stock (1,000 or 500) that the entity is entitled to receive at the close of each taxable year. For a partnership, be sure to enter the type of relationship; partnership, limited liability company and corporation. If the entity is not a limited liability company, complete “Other”. For all others who filed the 2011 Form 1065 — Qualifying Replacement Entity, enter the amount of capital contributions made by the non-qualified replacement entity. The amount of capital contributions is 5,000 to 25,000, with the 25,000 limit for a qualifying.